The Interplay Between Economic Growth, Inflation, and Interest Rates

The Interplay Between Economic Growth, Inflation, and Interest Rates

When the economy is thriving, businesses are raking in higher profits, and individuals are enjoying increased earnings. However, this economic growth can lead to inflation—the phenomenon where the overall price level rises due to more money circulating in the economy. But how do interest rates factor into this scenario?

Understanding Interest Rates

Interest rates represent the cost of borrowing money and are influenced by various economic factors. Central banks, like the Federal Reserve in the U.S., play a crucial role in managing these rates. As the economy grows, central banks often respond by raising interest rates to combat inflation.

- Mechanism of Interest Rates:

- High Interest Rates: When interest rates increase, borrowing becomes more expensive for businesses and consumers. This leads to a decrease in spending on goods and services, which can slow down economic growth and help stabilize prices.

- Low Interest Rates: Conversely, during periods of economic downturn or stagnation, central banks may lower interest rates to encourage borrowing and spending, stimulating economic activity.

Historical Context: The 1970s Example

A notable example highlighted in discussions of this topic is the economic situation in the 1970s. During this decade, the U.S. faced the challenge of high inflation paired with low economic growth. Several factors contributed to this scenario, including escalating oil prices and increased government spending.

The Oil Crisis: The 1973 oil embargo led to skyrocketing fuel prices, contributing significantly to inflation. This inflation eroded purchasing power, as consumers found that their money bought less than before.

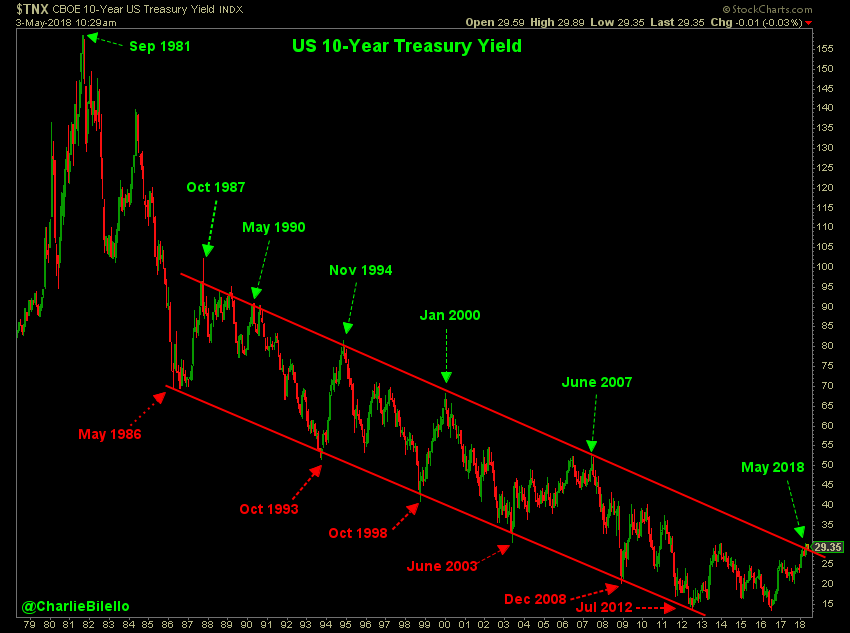

Federal Reserve Response: In an attempt to curb inflation, the Federal Reserve raised interest rates significantly, peaking at over 20% in the early 1980s. This drastic measure aimed to slow down the economy and bring prices under control, illustrating the delicate balance that central banks must maintain.

The Current Economic Landscape

In today’s economy, the interplay between growth, inflation, and interest rates remains relevant. With ongoing concerns about inflation rates post-pandemic, central banks worldwide are faced with similar challenges.

Global Supply Chain Disruptions: Issues like supply chain disruptions and labor shortages have contributed to rising prices, prompting discussions on how to effectively manage inflation.

Current Federal Reserve Policies: The Federal Reserve has signaled its intention to monitor economic indicators closely and adjust interest rates as needed to maintain price stability while supporting economic growth.

Practical Implications for Consumers and Businesses

Understanding how these economic principles interact can significantly influence financial decision-making:

For Consumers:

- Borrowing Decisions: When interest rates rise, consumers may think twice before taking out loans for major purchases, like homes or cars, as monthly payments increase.

- Investment Strategies: Knowing the relationship between interest rates and inflation can help consumers choose the right investment vehicles to preserve their purchasing power.

For Businesses:

- Cost of Capital: Higher interest rates can increase the cost of capital for businesses, leading them to reconsider expansion plans or new projects.

- Pricing Strategies: Businesses must also be mindful of how inflation affects their costs and adjust pricing strategies to maintain profitability without losing customers.

Conclusion

Understanding the relationship between economic growth, inflation, and interest rates is crucial for navigating the financial landscape. By keeping a close eye on these variables, individuals and businesses can make more informed decisions, helping to foster a stable economic environment.

For more insights into finance and economics, keep exploring MoneyMediums.com! Whether you're a consumer looking to make wise financial choices or a business owner seeking to understand market trends, our resources can guide you through the complexities of the economy.